Escalating Expenditures, Widening Deficits: How climate change driven disasters impact state coffers

With increased spending on relief and reconstruction, shrinking revenues, and mounting deficits, Indian states struggle to cope with climate-induced disasters' fiscal burden, according to a report by IIT Bombay.

By Debdatta Chakraborty / Feb 4, 2025

Image Courtesy: PTI

Climate change is accelerating the pace, intensity and frequency of disasters such as floods, cyclones, heat waves in India posing severe threats to ecosystems, infrastructure, and human settlement. India experienced extreme weather events on 255 out of 274 days between January and September 2024 marking a significant increase over the past two years.

These recurring natural disasters affect Indian states financially, challenging state governments to ensure fiscal stability in the face of climate extremes.

Based on an analysis of floods and cyclone events in 25 Indian states between 1995 and 2018, a research from IIT Bombay elucidates how extreme weather events are pushing India's state governments into deep financial distress. With increased spending on relief and reconstruction, shrinking revenues, and mounting deficits, Indian states struggle to cope with climate-induced disasters' fiscal burden.

The financial toll of disasters

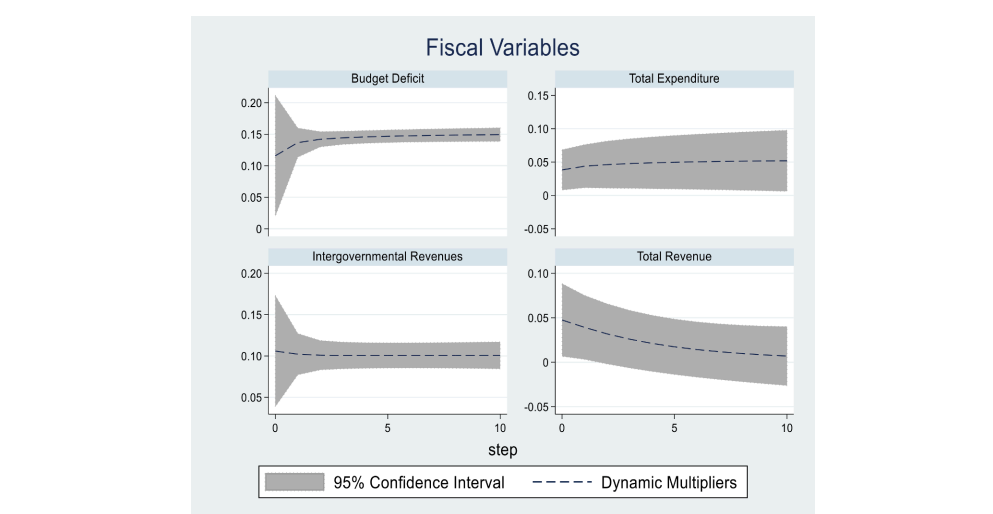

The fiscal ramifications of disasters on Indian states are profound in the era of climate change. The immediate effects include a sharp rise in government spending on relief efforts, reconstruction, and rehabilitation. This surge in social expenditure is coupled with a contraction in economic productivity, further exacerbating budget deficits.

Coastal states are particularly vulnerable, facing repeated cyclones and flood-related damages. These states experience a decline in both tax and non-tax revenue in the aftermath of disaster. Economic disruptions brought on by floods and cyclones result in reduced productivity, job losses and lower individual incomes, precipitating a decline in state revenue collected from personal income or corporate taxes. Long-term economic damage further strain non-tax revenues sources like interest payments, profits and dividends in the years following a disaster.

Rising Expenditures and Widening DeficitsDisaster response leads to rise in both social and capital expenditures of the state. Governments must allocate funds to essential services like healthcare, housing, food and nutrition support, and clean water. While these expenditures peak in the first year post-disaster, capital expenditures—such as infrastructure reconstruction—reach their highest point around the third year, leading to prolonged fiscal strain.

The study found that the gross fiscal deficit remained high for the first two years post-disaster, forcing state governments to resort to heavy borrowing. Loans from banks, financial institutions, and multilateral agencies like the World Bank, along with state development loans and other financial instruments, became critical lifelines. However, this borrowing trend indicates a growing dependency on external funding rather than robust internal fiscal mechanisms.

Building Back Better: Are relief funds adequate for disaster recovery

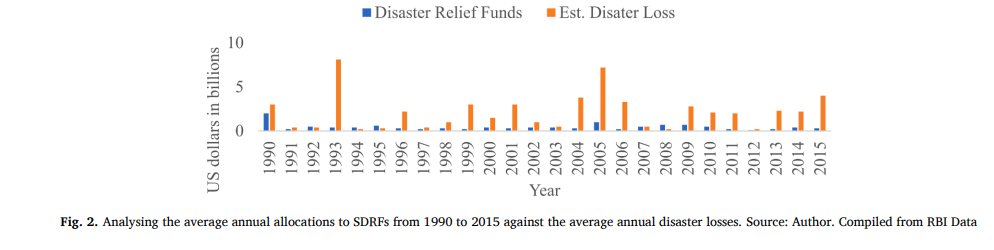

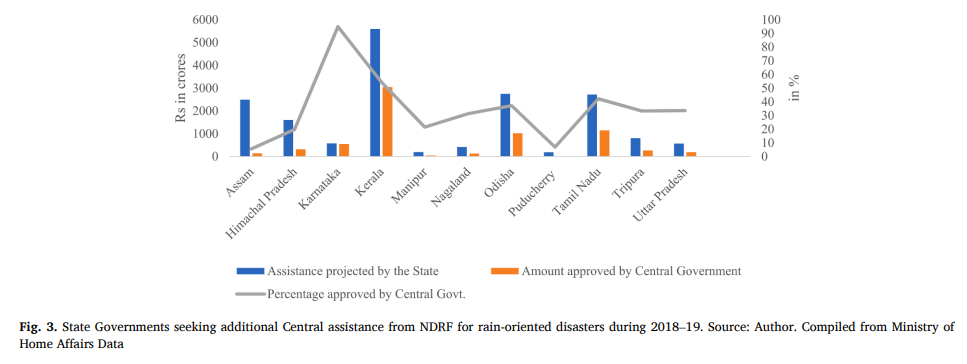

While the central government does provide relief funds through the National and State Disaster Response Funds (NDRF and SDRF), these resources are primarily allocated for immediate relief efforts. Long-term recovery and reconstruction remain the responsibility of state governments, leaving them financially vulnerable.

Disaster-prone states have started exploring alternative financial mechanisms. Andhra Pradesh has implemented the Apathbandhu Scheme, an insurance initiative for below-poverty-line (BPL) families affected by disasters. Meanwhile, Gujarat and Maharashtra are considering disaster bonds to aid in reconstruction efforts. Additionally, states like Odisha, Tamil Nadu, Kerala, and West Bengal are seeking private partnerships, corporate social responsibility (CSR) funds, and crowdfunding to bridge financial gaps.

A call for proactive disaster financing

The study emphasizes the urgent need for Indian states to shift from reactive to proactive disaster financing strategies. Traditional post-disaster borrowing is unsustainable in the long run. Governments must strike a balance between immediate disaster response and long-term fiscal sustainability, managing both the urgent needs of affected populations and prudent fiscal policies.

Instead, governments should consider instruments like Disaster Insurance, Catastrophe Bonds, and Resilience Bonds, which can provide immediate liquidity when disasters strike.

Reducing financial risk through adaptation

Investing in climate adaptation measures—such as resilient infrastructure, early warning systems, and sustainable land-use practices—can significantly reduce long-term financial risks. Public investments in climate-resilient infrastructure, such as flood defences and sustainable systems, protect private assets from climate-related damages and contribute to economic stability. Moreover, adaptation investments contribute to fostering sustainable development, ensuring that economies are better equipped to withstand the challenges posed by a changing climate. By prioritizing these initiatives, governments mitigate the economic and social impacts of climate change and reduce the long-term financial burden associated with disaster response and recovery.

Integrating climate risks in budgeting

Governments can incorporate climate considerations into their budgeting by conducting a comprehensive climate risk assessment, identifying and categorizing expenditures related to climate adaptation and mitigation, and allocating a specific budget for these initiatives. Odisha has already taken steps in this direction by incorporating climate-sensitive budget planning. Other states, including Maharashtra, Assam, and Kerala, are also tracking climate-related expenditures to ensure sustainable fiscal management.

Conclusion

The increasing frequency and intensity of climate-related disasters demand a fundamental shift in how Indian states manage their finances. The reliance on debt financing and emergency relief funds is proving inadequate in the face of mounting fiscal pressures. To safeguard their economies and ensure long-term sustainability, state governments must integrate climate resilience into their fiscal planning and explore innovative financial instruments.